the case for fine art NFTs

or, what i am buying and why. traditional artists with 1/1s are about to have their moment - are you ready?

hello friends,

if you’re here from my mailing list, today’s nft (notes, feelings, thoughts) is an essay about, well, NFTs (Non-Fungible Tokens). if you’re here from twitter, my essays begin with brief updates from my studio - so skip to the next header if you’re not interested.

studio updates:

i’m back in joshua tree painting a new collection, “SUMA PINTA: Beautiful Visions” the previews of which you can see on my Instagram - to be launched in 🤞🏼 November. DM if you see something you like.

i have a couple originals still available on my site as well as prints - and am booking commissions for late 2021/early 2022 if you have something specific in mind

i’ve quietly rebranded from amac things to alex maceda studio ✨ amac things was created in 2016 as a holder for all the things i was doing. as i’ve focused in on my creative work, i wanted a name to reflect that. a new chapter if you will!

when i first started nfts (notes, feelings, thoughts) with amac, my intention was to semi-regularly release thought pieces on the state of creativity in 2021. a lot has happened to distract me from writing, but i feel a wave coming on so hope to be in your inbox more regularly. i hope you enjoy the next piece and welcome feedback — if you enjoy it, please share with friends!

happy reading and many blessings,

amac

The case for fine (traditional) art NFTs or, what I am buying and why

Overview/**disclaimers**: NFTs are the wild wild west — prior to investing in the space, do your research and don’t trust any one source. I am an abstract oil painter and traditional NFT artist. As such, I write with both conscious/unconscious bias towards the niche of the metaverse I occupy.

The following covers what I am observing in the traditional (fine) art NFT space and how I am acting on those observations. The piece will be most interesting for those who have a basic understanding of the NFT space and/or who are interested in intersection of contemporary art and NFTs.

I use ‘traditional art’ and ‘fine art’ as a very clunky catch-all phrases for artists whose primary mediums are non-digital 2D, i.e. people who painted/drew in the real world prior to entering NFTs. The words ‘traditional’ and ‘fine’ are obviously fraught; it is not my intention to imply judgment or get into a discussion about what constitutes ‘traditional’ or ‘fine’ as it pertains to art. Simply put, I have found these words communicate the gist of what I mean in the quickest way, so we will stick to them.

This is not investment advice and, obviously, as a holder of many of the artists I mention I stand to benefit from an increase in their value. So, consider this all - DISCLAIMED! Now on with the show!

If you’ve been following my NFT journey on Twitter, you know I have been standing on my tiny anti-avatar soapbox, banging my anti-PFP pan out here in the desert, aka not flipping shit and staying crypto poor.

For the uninitiated, PFP stands for profile picture, referencing figure-based (i.e. humanoid or animal) NFT projects that collectors often use as their profiles pictures on Twitter. Without getting too much into it, outside of buying and selling for profit, and ease of onboarding and benefits of built-in community (which should not be underemphasized), some/much of the value of these projects are in this use case - i.e. signaling and proving you own one and letting that become your personal brand on Twitter. This tactic is most often used by owners of Cryptopunks (the creme de la creme of the avatar - and debatably, all - NFT projects) or Bored Ape Yacht Club (BAYC).

PFP projects are decidedly not what this article is about, but the context is important, if not obvious, for anyone already collecting in the NFT space. In the past few months there has been a proliferation of PFP projects, often boasting ‘10k unique characters’ with different attributes and corresponding rarities, and a standard launch checklist of influencer shills, Discord drops, etc., etc.

The sheer insanity of some of the numbers of these drops (e.g., at the time of writing the original BAYC has traded 190Keth or $760M (!!!) in volume, with the cheapest single NFT listed at 35eth or $140k (!!!)) has contributed to both the rush into, and the skepticism of, the NFT space. Hopefully the reason for the rush is obvious to you — newbies rushing it hoping to snag the next million dollar NFT project and flip it for a huge profit, artists hoping to draw some doodles (sorry not sorry for being reductive) and capitalize on the same. For someone brand new to the NFT space, I actually do think buying a PFP is a great first move in the space — but that’s another article for, let’s say, next week. ;)

In March I wrote a piece touching on why I thought starting a PFP project as a traditional artist was a waste of time. In short, if you have the time and a desire for a long-term career, with so much promise in the NFT space for traditional artists, I challenge the focus on a PFP project rather than the development of a project highlighting your own unique work. If you don’t believe me now, hopefully you will by the end of this article. Anyway, I digress! Too much time focused on PFPs already! Let us focus on the investment thesis for fine art NFTs.

I entered the NFT space in February and from the get go I started actively looking for traditional artists — first out of interest (as I wanted confirmation there was a place for us) but quickly also for investment. While I am very much a child of the internet, I am also an art historian (and classicist) by schooling — which made me bullish on traditional art NFTs from the get go.

My thesis from the beginning was that, if one is to believe that crypto/NFTs is not only a technological - but in my opinion an art historical - movement, the history books will be interested in the individuals that were at the forefront of merging the old (traditional) and new (crypto) worlds. The books will, of course, be very interested in the big digital, crypto-native artists — but (I believe) they will also be interested in the dialogue and tension between the old and new world and the artists existing in that liminal space: those individuals that are merging gallery practices with NFT practices. That is my blue sky, long-term thesis for traditional art NFTs: art historically relevant. In 20 years, isn’t it reasonable to believe the Sotheby’s of the world will be falling over artists who merge the two practices (and… aren’t they already?).

Zooming back in — and acknowledging my near-immediate-anti-PFP bias — I also had a medium-term, let’s say 6 to 18mo, thesis re: fine art NFTs. From my brand/consumer background, I see PFPs equivalent of the ‘logo mania’ trend in fashion — collectors chasing visible clout as they emerge into a new peer set; the distinguishable ‘cat-as-profile-pic’ is the equivalent of a Supreme sweatshirt. But as in fashion, trends come and go and inevitably, the future trend is often a direct-backlash to a distinguishing characteristic of the current. I see the backlash to the 10k project as the 1/1 NFT, the backlash to the cartoon character is — dare I say — abstract art? ;) I say that last part in jest/with hope, but I do think a more traditional looking piece of art, whether figural or abstract, is a natural flip of response to the character and pixelated work that dominate our bird app feeds today. One could argue that the emergence of generative art into mainstream NFT culture in the past few months is the beginning of this phenomena.

With all of this in mind, my thesis has been that as the NFT market matures, so will the equivalent of ‘quiet luxury’ and the ‘if you know, you know’ type flexes: brands (artists) that thrive on a distinct look, defendable brand, and non-mass mass market recognition. I see all of this as tailwinds for fine art NFTs and traditional artists — these are individuals who have existed in the traditional art/gallery world (whether actually in or gatekept out) who are building a body of work and persona (“brand”) that is recognizable and continuously growing. For me, part of being a ‘traditional’ artist is having inherently physical practice, i.e. for the most part, a physical painting or drawing practice (or sculpture, architecture, photography, etc.). Despite the digital nature of NFTs, I have been bullish on the importance of this since the beginning (small flex - but I am one of the first oil painters to successfully sell merged NFT/physical work) — partially because I believe (1) people inherently like physical objects, but mostly because (2) I think we will see (and are already seeing) the traditional art world embrace NFTs as part one’s creative body of work. While these galleries might (and already) show digitally, I do not think physical shows are going away anytime soon. It stands to reason that artists with both a physical and NFT practice will then become particularly intriguing. And on the flipside, as NFTs become more mainstream, we will naturally move from the metaverse to shows in the physical dimension (again, already happening). Screens are nice, but physical work is nicer (if not a welcome complement to the former in the art shows of tomorrow).

“Very nice amac, so where is the alpha?”

In the default world, I straddle a few different communities, one of which - and I say this with all the love in my heart - is excitable MBAs with a desire to generate alpha who want to know what they should buy and/or what I am buying, and why.

At this point, and before I answer, I generally like to wax poetic about how there are no guarantees in life and that the best way to give the universe a laugh is to come up with a plan and be sure about it. Or, in non-spiritual speak, that none of the following is investment/financial advice. But that - have you met me? - of course I have a framework with which I am making my decisions. So you got this far, here it is.

For the past >six months, I have been investing in 1/1s by traditional artists — **period** end of sentence (addendum: I do have a Mooncat and Slimyskater). Here is what I have been looking for, with artists called out as case studies/examples. As I said above, obviously, as a fine art NFT artist myself, and as a collector of the artists below, I stand to benefit from any increase in activity around our work specifically and in this niche in general. So, bias - unconscious and conscious - abounds. 🤗

I have been looking for:

(1) An academic, for lack of a better word, approach to the space — active communication of a vision for something bigger for the art world

There is a lot of skepticism and confusion in the fine art world around NFTs. With the exception of the other artists in TMFA community, literally none of the fine artists I know have minted NFTs. The space is confusing and, to artists who are gunning at a gallery practice, appears to be a total waste of time. The barriers to entry are quite high (time, money), all things considered. So why would a fine artist dive in?

For some it was a fluke or an obvious next step to their crypto-side hobby, but for others it was a very intentional move that shared the broader art historical viewpoint I outlined above. This is less relevant in October 2021 (as this POV is more common), but in March 2021, I actively was looking for fine artists whose content (tweets) were outlining this POV — those that were actively challenging the gallery world, placed digital/NFT art in a historical context, or who were actively advocating for the economic opportunity that the NFT space was creating (i.e. a different future for artists).

These might seem like obvious points of view, but they’re not. Scroll through NFTwitter and you will see tons of artists shilling their work with little talk of cultural or really any context. In a world where we are inundated with content and images, the quality of conversation around one’s work becomes a differentiating factor. In the traditional world, a gallery or curator defines the conversation on the artist’s behalf. In NFT land, gatekeepers be damned! artists control their own narrative, primarily via their Twitter accounts — and those that can continually place their work in a broader context, whether it be an existing NFT trend or an art historical movement will thrive.

Also frankly, those tweeting about more than just their one piece have more interesting accounts. More interesting accounts = more followers, and more followers tends to = more sales, more sales = more success. While an academic background (i.e. MFA) is not necessary, I certainly did notice that those who listed MFAs tended to be in this group.

Which brings me to our first artist: Evan Odette (@ROMbrandt). I should start by saying, Evan hits basically everything I will outline in this article and, IMHO, is a masterclass in fine art NFTs. I bought my first of his V.o.S. collection pieces at 0.1eth, the floor at the time of writing is 0.9eth (9x) with 77.7eth traded. Insane.

I connected with Evan in very early days (March), at first, simply because he was an extremely talented oil painter, and then became intrigued with his content outlining his experience within the traditional art world (see above). More interestingly, I watched Evan experiment with 1/1s, digital/physicals then expertly do a fine art take on the traditional PFP/collectible project — in other words, he created…

(2) An early collection with a distinctive/recognizable look combined with other minted work that demonstrates breadth

When I put my collector/investor hat on, a 1/1 fine art NFT is frankly disorienting. Of course, there is a great value in buying something just because you like it — but, not many people approach the space like that (if anything, because it requires disposable income), v wishful thinking IMO. Most people buy something because of perceived future value, which in the NFT space means potential for secondary sales. Again, this seems obvious, but I have been surprised at how many emerging artists I’ve spoken to who are not making this connection. So, as a collector, I am interested in artists who are setting their work up in a way that is more secondary sale friendly, which brings me to the collection.

Let’s say you see a fine art 1/1 NFT priced at 1eth — how do you decide to buy it, especially if 1eth is a meaningful amount of money to you? As a 1/1, it generally sits by itself, with no context, except for its relationship to its artist. So then you turn to the artist — if they are new and unknown, how do you know to make a bet on them? There is no guarantee they will stay in the space (especially with it being so early) and there is no history of work to fall back on. Plus, as discussed above, the upside in the NFT space is secondary sales. Secondary sales increase as interest, enthusiasm, and buzz in an artist/project increases. How much buzz can you create over a 1/1? Not a lot, especially if you’re new and not porting over a large, crypto-friendly audience. But buzz around a 100 or 10k project - that’s has the potential of 100 or 10k owners, all tweeting, plus all the people trying to get into the project. Eventually this becomes your community. See where I’m going?

Structurally, collectible and PFP projects have fine art beat. Your classic 10k PFP project hits a lot of the above — the potential for a lot more buzz simply due to the number of owners of the collection, the creation of a roadmap with somewhere to go, a ‘drop’ of multiple NFTs which creates the history, often some good storytelling which fills the ‘story of the artist’ bucket, and a vibrant community of collectors interacting with each other and the project constantly. Ding ding ding — jackpot.

As I have looked at what artists to buy, I was attracted to those that seemed to observe the above and apply it to fine art. Or perhaps — those that took the traditional art world’s ‘collection’ concept — and applied it to NFTs ;) A collection = a grouping of work around a similar theme that gave the work, and the future collectors, context and structure.

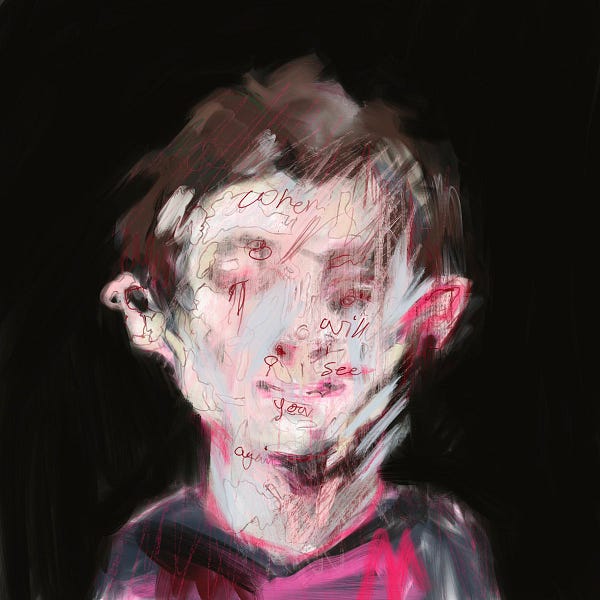

The latter was true for Evan, who started minting is Visions of Self (V.o.S.) series on Rarible, now on Opensea, a collection of 200 portrait paintings. A classically trained oil painter, Evan started the series quite literally with an oil underpainting on which he added digital painting on top. I’ve watched the series sell relatively slowly at the start then pick up speed — Evan developed a roadmap, started a discord, experimented with tokenized commissions, digital/physical drops, collabs, collages… and now has auctions regularly ending in multi-eth prices and collabs with heavyhitters like Lirona. In other words, he has actively applied NFT trends to a structured project with fine art bones.

Outside of/before V.o.S., Evan has minted other work that shows breadth, if not just pure painting proficiency (dare I say expertise) — I sneaky snagged a digital/physical of his (NFT + oil painting) for 0.33eth last week. The breadth is important for me because it shows promise for what could happen after one’s first collection is complete.

Getting back to secondary sales and future sales, the recognizable collection IMO is one of the most brilliant moves a fine artist can make. It gives collectors something to orient around and hold onto, and brings in a large number of collectors at a reasonable price, and starts to create community around one’s work. The traditional art world would have you think in terms of scarcity and high prices — release a few NFTs, price them high. But in NFT land, that does not fly. I’ve watched many (well-known) traditional artists I admire take this route, fail, then drop out of the space. Scarcity = fewer collectors and fewer collectors = less buzz and community early, i.e. harder to build your NFT career.

As eth grows and as early collectors get more savvy, they come along for the ride with you as an artist. It is in a collector’s best interest for you to grow, so the more collectors you have early on, the more people in your court & Twitter timeline. Then, the thesis goes, as the collection sells out and the following grows, future collections, and eventually highly priced, one-off 1/1s, sell quickly. Which brings me to, IMHO, the king of abstract digital - Jack Kaido (@thisjackkaido).

I connected with Jack early on because of his beautiful abstract work (if you don’t know my work, I am an abstract oil painter… hence…). Jack’s practice is wholly digital, but I place him squarely in the fine art bucket as a maker, from the get go, of painterly 1/1s.

Jack was one of the first 1/1 artists I saw employ a collection strategy — first with Polaroids, then with Waves, two Opensea collections that mimicked the ‘collection’ one might see at a gallery — a set of 1/1 works with a distinct aesthetic. If you click on either collection, the distinctiveness is abundantly clear (size, border, color scheme, etc.).

I passed on Polaroids (sorry jack ily) because it didn’t resonate with me aesthetically, but jumped at Waves - buying the below at 0.12eth in June. At the time of writing, the floor price for the collection is 6eth (50x). Polaroids floor is 10eth (pain!). Don’t tell me there is no alpha in fine art!

If you follow Jack on Twitter, you know he is extremely diligent and intentional about releasing work. For me, this is another positive signal for a fine art NFT artist:

(3) Intentionality around process (discipline around quality, thoughtfulness in release schedule)

In a space where everything is changing so fast and people are chasing things right now, demonstrated discipline and dedication to quality of work is supreme. As I look through my peers, I ask myself — what role does intentionality play in this person’s process and (as this entire process is inherently judgmental), do I agree with the way in which they execute said intentionality? Again, very subjective, but a relatively good proxy for this is speed of release of collection. The assumption I am making here is that “slow” speed does not signal laziness, but rather, signals that the artist is intentional about the work they release and not just chasing $. I would venture to say fine art lives on a different timeline than your typical NFT project, and that timeline is inherently slower.

Back to Jack: his first collection, Polaroids, was released ~Feb 2021, Waves was released 3mo later and it was another 4mo before he released Errors on Known Origin. As of writing, Jack’s work is currently on the KO homepage. The most expensive single piece of Errors sold for 5eth. A few months ago his work was selling for 0.05eth. Probably nothing.

If anything, as an artist, the NFT space is deeply FOMO and anxiety-inducing. To have the presence of mind to move with this speed and intentionality, one has to have confidence in and vision for their work. The inner confidence that underlies intentional movement is an intangible we do not talk about enough as artists — that is what gets you through months of no sales and bear markets. In a world where you’re making decisions based on Twitter feeds and releases, speed x quality of release is the best proxy I’ve found for it.

Implied in all of this, of course, is that there are no overnight successes in the fine art NFT world — contrary to the dominant belief of those not in the space. I’d argue it is the same for the PFP world, but even more so here — regularity, commitment, and quantity of work is a precursor for future success.

(4) Authenticity in connection and desire to build up their niche of and/or the traditional artists in the space

Another thing Jack exhibited from the get go was a desire to lift up and connect with other artists, particularly abstractionists. If you go through his feed, it is filled with retweets of other artists and their work. As an artist, I’ve found many of my early collectors are other NFT artists. There is a beautiful culture in the NFT space of making a sale then using your funds to buy a peer’s work. *Collector hat on* practically speaking, artists that display a desire to connect and relationships with other artists have a leg up in ‘brand’ building. In my experience, the NFT space is one of ‘a rising tide lifts all ships’ — those who believe the opposite, ngmi. The most active people on Twitter are the artists — so if other artists are supporting your work, your work tends to get more views. If an artist who supports you gets more successful, you get lifted with them. As the space grows, and especially as specific niches (i.e. abstract art, fine art) grows, so do all the artists related to it.

Back to alpha — I believe, those artists who are actively pushing forward their niches are best positioned to capitalize when their niches come into vogue. In the time between Waves and Errors, Jack published what is (probably) the only long-form essay on the state of abstract art as it relates to NFTs. It was brilliant, interesting, and further served to position his role as a leading NFT abstract artist and thinker: an academic approach that pushed his niche forward.

Another exceptional example of this is James (@altjamesA), another digital-only abstractionist, ex-curator, ex-art school artist. Very early on, James created the first (?) list of pure abstractionists — pulling the eyes of everyone who identified as such onto his feed and pushing forward the hashtag #abstractdigital. If you are an abstractionist, chances are James is on your radar.

His 10x10 Xs collection on Opensea is another exceptional case study on the ‘collection’ model — an extremely clean, structured, and well-executed (and intentionally launched) collection of 100 1/1s all around the theme of the X. I bought number 99 at 0.1eth, the floor at the time of writing is 0.8eth (8x).

(5) Pure artistic talent - either the most objective or subjective filter, depending on who you are

Underlying all of the above is needing to have what I see as pure, plain old, artistic talent. I don’t know how to quantify that for you — if you have taste you have taste, if you don’t, ngmi. 😘 I kid, but really, my approach has been to buy what I like but pushed through the above filter with the intention of holding something that has long-term value, either financial or art historical.

There is something to be said though about coming across an artist with such a distinctive style that you have a gut-feeling they are going somewhere — which is how I ended up with one of Varvara’s (@VarvaraAlay) first 1/1s back in July.

Varvara is a collage artist and educator — I think I spent all of a minute on her Foundation profile before purchasing this piece. At the time she had <200 twitter followers; 3mo later, she has 3.5k. I was taken by her work immediately: it was unlike anything I had seen in the space and merged a practice that was inherently physical (collage) in a style that really lent itself to digital. I immediately also thought her figures would lend itself to a collectible (narrator: she was right). Her art educator background has no doubt informed the thoughtfulness and strategy with which she’s moved from 1/1s on Foundation to collections on Opensea. Her Twitter feed and journey is worth a deep dive.

Since, she has become another masterclass in fine art NFTs, hitting much of what I outlined above, and *GASP* soon releasing a 10k PFP project based on her style of work. Yes, I will make an exception to buy this — and yes, as a 1/1 collector I am already entitled to one. The project is so distinctive and it is clearly Varvara’s — I love this move as an artist; the focus on trend still pushes your career forward as the PFPs themselves as very much in your style of work (vs. releasing a one-off pixel project that looks nothing like your portfolio).

An emerging thesis: (6) Exploration out of physical into digital in novel ways

Moving back to today, and thinking of tomorrow, what will I be looking at as traditional artists in the space mature and the above becomes more playbook, less leading edge strategy? I’m very interested in how physical practices are being translated to digital in methods beyond digital painting or simply animating a still image, whether 3D or otherwise, which brings me to Lisanne Haack (@paranoidhill).

Lisanne is an extremely talented digital/physical abstract oil painter who hits much of the above. She is very involved in the community, especially with other female artists. Her studio work tends to be wet-on-wet abstract oil, as were her first NFTs. I watched her animate these paintings and over the past few months evolve, expand, and innovate in her method of translating her physical work and point of view into new methods of digital — see below.

I am not yet a collector of Lisanne’s — extremely painfully, I missed out on her 0.1eth 1/1 NFT collection on Opensea, because #gaswars. A typical NFT sob story 😭 If you haven’t noticed, I am no crypto-whale and am very much the collector that comes in early at a low price; I tend to buy in the 0.1-0.2eth range and then price myself out. I will surely be on the lookout for more of her work and am excited to see how her career progresses into 3D.

COUNTERPOINT

I have yet to find an absolute truth — in art, NFTs, investing, and life itself. I love a counterpoint, if not to give hope to those artists who don’t feel the above is authentic to them, then to challenge dualistic thinking in general. Which brings me to Sophie Sturdevant (@sophiesaidso). I love Sophie’s work, as (modern) figure drawing holds the most special place in my heart, but more over, I think she is a brilliant art/strategy mind with a lot of adjacent takes on fine art, creativity, and NFTs that have already made her a thought leader in the space.

As a counterpoint to the collection thesis above, Sophie taken the strategy of fewer, higher priced (rarely under 1eth) pieces, listing primarily on Foundation. This is a gutsy strategy I admire that not many artists, especially brand new to NFTs, can pull off. I have not connected with Sophie personally, but from afar, I attribute this to her patience/dedication to her practice, active effort in building community in the space, built on top, of course, by pure artistic talent.

In conclusion…

We are in the early days of traditional art entering the NFT space — the early movers and winners bear the burden of both education about the niche and innovation within the space. The most interesting players combine the best of fine art and NFT trends: an intentional and distinctive fine art practice, discipline in collection strategy, and the community-building structures of PFP projects.

It is only a matter of time before fine art 1/1 NFTs become the dominant trend, if not for good, then for a moment, which for many artists is all they need to experience life-changing success. There is alpha already in the space and in my opinion, a lot more joy in collecting work from individuals who are pushing the dialogue and thinking of both traditional and digital art forward, and who are throwing their whole selves into inherently personal work. And, unlike in the traditional art world, the NFT space often includes a direct, personal connection between artist and buyer, with no middleman in place.

My wallet is public, so you can view the work I hold that has not appreciated. Almost exclusively, these artists have either left the space or released work sporadically and without structure. But, still early, lots of time for them to come back. 🙃

It is my hope that this article inspires more collectors to invest in fine art and traditional artists — and inspires more fine artists to enter the NFT space. I continue to be bullish on both and welcome dialogue and thoughts about my observations. Again, this not investment advice, is highly influenced by where I sit and what I’ve seen. The space is changing so quickly, so this is sure to be outdated in months, if not weeks.

Clearly I am a huge art & NFT nerd. If you are too, please meet me in my DMs! You can connect with me on twitter at @_alexmaceda_ or on instagram at @alexmacedastudio. You can view my NFTs on Opensea (desert minis, abstract art) and Foundation and my physical work on my website, alexmacedastudio.com.

Be well and collect beautiful art! 💖

amac

BONUS: one of the most common questions I still get is “what PFP project should I buy and why?” *sighs deeply* so, here are a couple of the best threads I’ve seen (that are still not investment advice):

Great thread on what @punk2476 (formerly artchick, great personality/thinker in the space) looks for in a 10K project

Another great thread on how to identify ‘scam’ PFP projects by @DCLBlogger, implies what you should look for in a great one.

S/O, H/Ts, and Thank Yous:

Thank you to all the artists mentioned, none of whom knew they would be written about, most prior to publishing, a couple until they saw the final draft. I admire and appreciate your work and what you are doing for the space! ❤️

S/O of the early readers of this article and an extra thank you especially to those who provided edits and/or pushed my thinking and approach: @0xLILPUP, @morewoke, @maybe_sandy, @thisisjackkaido, @alavery2.

H/T to non-NFT artists (for now…) @hamzat.raheem and @austyn_taylor whose art historical thinking and approach to their own practices have meaningfully expanded my own in the past year.

S/O to @morewoke and @tmfacommunity who have been my creative/NFT community from the earliest of days 🤗

And thank you to the NFT community for creating a space where an artist that loves shitposting as much long-form academic articles is embraced, wagmi 🥺